From Source to Exit: Building the Operating System for Private Capital Markets

The private capital markets—spanning venture capital, private equity, angel syndicates, investment banks, and family offices—are undergoing a structural transformation. Global private capital assets under management surpassed $13 trillion in 2025, with continued growth projected through 2030 as institutional and private investors seek differentiated returns beyond public markets.

Yet despite this scale, private markets remain burdened by fragmented workflows, opaque data, and relationship-dependent deal flow. According to recent industry research from PitchBook, over 60% of private market professionals cite operational fragmentation and poor data integration as their top constraints to scalability and performance.

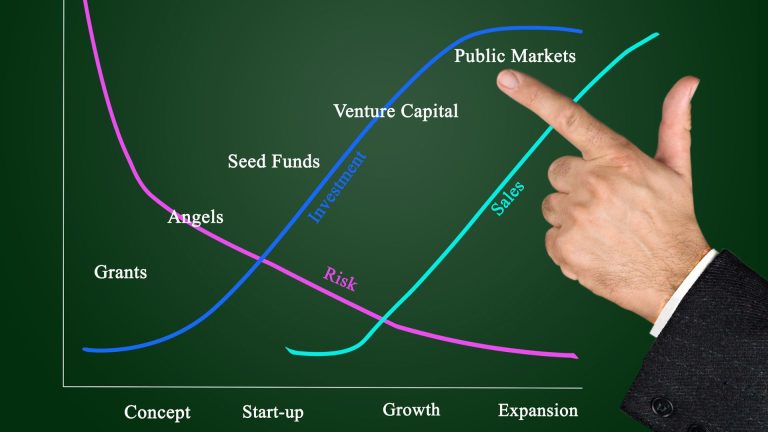

Re-Thinking the Private Capital Lifecycle

One of the core inefficiencies in private markets is the absence of a single, integrated operating system that supports the entire investment lifecycle—from sourcing and diligence through execution and exit. Most firms still rely on disconnected tools, spreadsheets, email threads, and legacy databases, slowing decision-making and increasing risk.

Konzortia Capital addresses this challenge with its Source – Match – Exit™ framework—a lifecycle-driven strategy designed to unify how capital is discovered, deployed, managed, and realized.

By combining AI-driven analytics, centralized data intelligence, and transaction-ready infrastructure, Konzortia Capital enables investors and capital-raising companies to operate with greater speed, transparency, and confidence across every phase of the investment journey.

Source – Match – Exit™: A Connected Investment Framework

At the core of this ecosystem is Alpha Hub, the company’s flagship platform. Alpha Hub delivers AI-powered deal sourcing, capital raising, diligence workflows, and pipeline management within a single environment. Machine-learning models continuously analyze investment criteria, market signals, and company performance indicators to surface higher-quality opportunities faster.

But Alpha Hub is only the foundation.

Konzortia Capital’s broader platform strategy extends across the full investment lifecycle:

Alpha Markets (coming soon)

Designed to unlock liquidity through secondary transactions and structured market access—addressing one of private capital’s most persistent constraints.

Alpha Blocks (coming soon)

A distributed-ledger layer that enhances transaction security, auditability, and settlement efficiency through smart contracts and digital infrastructure.

Alpha Terminal (coming soon)

A real-time intelligence and analytics layer providing benchmarking, risk modeling, and portfolio insights to support smarter exit timing and value creation strategies.

Together, these platforms function as an end-to-end operating system for private capital, reducing friction while improving visibility, governance, and ROI.

Why This Matters for Investors

As competition for premium assets intensifies, speed, precision, and trust have become defining advantages. Investors are no longer just underwriting companies—they are underwriting infrastructure, data integrity, and execution capability.

By investing in platforms like Konzortia Capital, forward-looking firms gain exposure to the next generation of private-market infrastructure—technology designed not to replace relationships, but to scale them intelligently.

As Walter Gomez, Founder of Alpha Hub, notes:

“The future of private capital lies in reducing friction and improving transparency at every stage of the investment lifecycle. Source – Match – Exit isn’t just a framework—it’s a new operating model for how private markets work.”

Conclusion

Konzortia Capital is not simply building tools—it is re-architecting how private capital markets operate. By connecting sourcing, execution, and exit into a unified digital ecosystem, the firm is positioning itself at the center of the next evolution of private investing.

For venture capital firms, private equity funds, family offices, and investment banks, the question is no longer whether private markets will modernize—but who will lead that transformation.

References:

- Preqin. (2025). Global Private Capital Report 2025.

- PitchBook. (2025). Private Capital Technology & Infrastructure Trends.

- McKinsey & Company. (2025). The Future of Private Markets: Scaling with Technology.

- Bain & Company. (2025). Private Equity and the Digital Operating Model.

About Konzortia Capital: Konzortia Capital is a next-generation FinTech holding company revolutionizing private capital markets through Alpha Suite—an integrated ecosystem powered by artificial intelligence, machine learning, and blockchain technology. Anchored by Alpha Hub, Konzortia simplifies every stage of the investment lifecycle, from intelligent deal sourcing and capital raising to due diligence, pipeline management, and transaction execution.

Guided by its proprietary “Source–Match–Exit” model, Konzortia addresses market fragmentation by uniting investors, issuers, and intermediaries within a single intelligent infrastructure. Through its complementary platforms—Alpha Markets (secondary liquidity), Alpha Blocks (blockchain-secured transactions), and Alpha Terminal (real-time market intelligence)—Konzortia delivers a seamless, data-driven environment designed for speed, transparency, and smarter decision-making.

#PrivateCapitalMarkets #PrivateEquity #VentureCapital #FamilyOffices #FinTechInfrastructure

#DealSourcing #PrivateMarkets #AIinFinance #InvestmentLifecycle #CapitalMarkets