From Source to Exit: How AI Is Rewiring the Private Capital Lifecycle

In the evolving landscape of the private capital market, investment firms across categories—from venture capital, private equity, and angel syndicates to investment banks and family offices—are increasingly turning to artificial intelligence to optimize every phase of the investment lifecycle: Source, Match, and Exit. Where deal sourcing, matching potential partners, and executing exits once depended heavily on manual research, networking, and intuition, today’s frontier is about AI-driven deal sourcing, precision matching, and optimized liquidity through secondary markets.

The “Source” Phase: From Manual Spreadsheets to Smart Deal Discovery

Historically, deal origination for many firms was labor-intensive: scanning industry reports, attending conferences, cold-calling brokers, and tracking leads in disparate spreadsheets. But research indicates that many private equity firms are seeing only a fraction of the relevant opportunities in their universe—for example, one study found that firms capture a median of just 15.8% of deals in their target market.

Enter AI and predictive modeling in finance: tools leveraging machine learning, natural language processing (NLP), and data-driven investing to scan vast datasets, identify patterns, and surface companies that may not yet be on the radar. For instance, one report states that AI can identify 195 relevant companies in the time it might take a junior analyst to evaluate one.

Moreover, an estimated 70% of firms in the venture capital or private markets space report adopting AI for functions like sourcing automation, market research, and internal productivity.

In practical terms, a VC firm or family office might use an AI-powered platform to ingest news articles, hiring data, competitor moves, and funding histories, then automatically score and prioritize targets—a classic example of smart deal sourcing or intelligent deal matching.

As Walter Gomez, Founder of Alpha Hub, puts it:

“In the era of data-driven investing, the firms that win aren’t those with the best relationships—they’re the ones that build the best pipelines faster.”

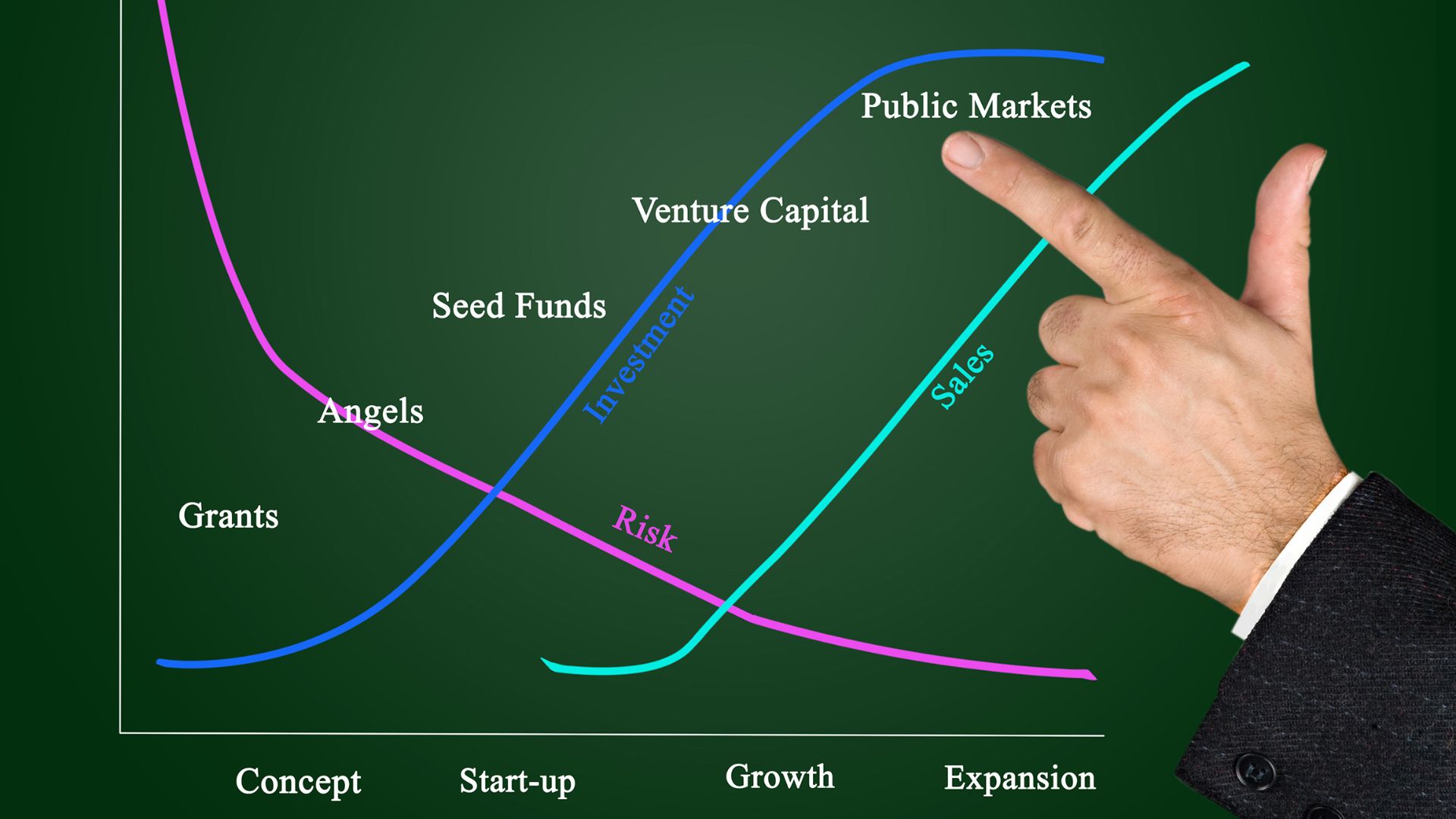

For investment banks, angel syndicates, and family offices especially, this means getting access to more and earlier-stage opportunities, reducing time from sourcing to evaluation, and gaining an edge in crowded fields.

The “Match” Phase: Precision Evaluation and Portfolio Fit

Once a potential target is identified, the next step is matching it to the investing firm’s thesis, structure, and exit possibilities. Here too, AI is transforming workflows. Through private equity analytics, machine learning in investing, and data-driven investing, firms can deploy tools to evaluate fit—by analyzing historic deals, sector growth, competitive positioning, and even weak signals (e.g., talent flow or leadership churn).

In the realm of private equity (PE) and venture capital (VC), adoption is growing rapidly, driven by digital transformation in finance. Recent data shows that approximately 75% of private equity firms are incorporating or planning to incorporate AI within 12 months.

For example, an AI-enabled platform may help an angel syndicate or family office automatically screen hundreds of companies by thesis fit, revenue trajectory, or network connectivity, then prioritize the top decile for deeper diligence—essentially leveraging AI investment platforms and investment matching algorithms. The result: faster turnaround times, more consistent evaluation processes, fewer manual errors, and a stronger pipeline of qualified opportunities.

The “Exit” Phase: Optimizing Liquidity in Secondary Markets

The final stage—exit—also stands to benefit from AI innovations, especially as secondary markets become more active and complex. Firms leveraging AI-driven transaction management can simulate exit outcomes, optimize timing, and engage potential buyers or secondaries sooner. According to industry research, the median time for companies to reach $10 million in revenue has collapsed from 10 years to just 12 months, due in large part to AI-enabled business models.

Firms that integrate advanced analytics in private equity and portfolio-monitoring tools are better positioned to capture value at exit. For instance, in post-acquisition phases, about 45% of investors report active AI usage in value-creation plans, and another 38% plan to adopt it shortly.

From a strategic viewpoint, private equity investors, family offices, and investment banks can now identify optimal exit windows, evaluate secondary-market interest, and even optimize structuring of deals for future liquidity—all through platforms built for “source-match-exit” cycles.

Why Speed, Precision, and Connectivity Matter

In today’s hyper-competitive environment, the firms that win are those that move fastest, with the greatest precision and connectivity. Investment lifecycle optimization is no longer optional. A handful of notable statistics underscore this:

- AI adoption in deal sourcing and portfolio value creation is on track, with about 75% of responding private equity firms incorporating or planning to incorporate AI within 12 months.

- The global private investment into AI companies (those that received more than $1.5 million) has grown steeply in recent years.

- Firms leveraging AI tools report dramatically faster evaluation and due diligence workflows.

For venture capital technology firms, private equity analytics specialists, and secondary transaction platforms, this represents a compelling investment opportunity. Investment firms—whether VC, PE, syndicates, banks, or family offices—can allocate capital not only into portfolio companies but into the leading companies that are providing greater operational efficiency for the private capital market sector’s needs.

Strategic Implications for the Investor Community

For venture capital funds, private equity houses, angel syndicates, investment banks, and family offices, the implications of AI across sourcing, matching, and exit are profound:

- Competitive advantage: Firms that build or adopt AI-driven platforms will uncover overlooked opportunities more efficiently than laggards relying on legacy manual workflows.

- Operational leverage: Deploying deal sourcing automation, investment decision intelligence, and intelligent automation in private capital management reduces time and cost in sourcing and diligence.

- Enhanced returns: Through better matching and exit optimization, firms can improve internal rate of return (IRR) and liquidity outcomes—especially in secondary markets.

- Investment into enablers: There’s a parallel opportunity to invest in companies providing private market technology, AI investment platforms, and secondary transaction platforms; these firms are instrumental in reshaping how the market operates.

- Risk mitigation: AI and data-driven investing support better identification of risk, earlier red flags, and improved governance over investment pipelines.

As Walter Gomez of Alpha Hub notes: “When speed and data intelligence replace sheer rolodex power, the firms that adapt will define the next generation of returns.”

Conclusion

In an era where data is as crucial as capital, the private capital lifecycle—from sourcing deals, matching opportunities, to executing exits—is being rewired by artificial intelligence. Investment professionals across the spectrum—venture capitalists, private equity sponsors, angel syndicates, investment bankers, and family offices—must embrace this shift if they are to keep pace in a market defined by speed, precision, and connectivity. Moreover, there is a fertile opportunity to invest in the platforms and services that enable this transformation, further amplifying value.

The question for every firm is: will you lead the transition from manual workflows to fully integrated source-match-exit AI-powered cycles, or will you fall behind in the new era of investment intelligence?

References:

- “How Private Equity Firms Are Creating Value with AI”, Harvard Business Review.

- “How AI is shaping the future of deal origination in private equity”, Affinity blog.

- “Private Equity Industry Report 2024-2025”, Nomadic Software + Software.

- “From Insight to Action: The Data and AI Driven Evolution of Private Equity”, Tideshift.

- “A deep dive on AI and Machine Learning private equity investments”, PrivateEquityInfo.

- “How tech innovations are transforming private equity”, World Economic Forum article.

- Private capital innovation: Using artificial intelligence can accelerate the portfolio valuation process – Deloitte

- The impact of artificial intelligence on private equity firms – Kearney

- Nearly 70% of private equity firms have at least one dedicated BD role, M&A Press Reports -Sutton Place Strategies, by Bain & Co.

- A new wave of AI-led disruption: The private market opportunity – J.P. Morgan

- Bite Stream Insider: Sky’s the limit | Why AI in private markets is just getting started – BiteInvestments

About Konzortia Capital: Konzortia Capital is a next-generation FinTech holding company revolutionizing private capital markets through Alpha Suite—an integrated ecosystem powered by artificial intelligence, machine learning, and blockchain technology. Anchored by Alpha Hub, Konzortia simplifies every stage of the investment lifecycle, from intelligent deal sourcing and capital raising to due diligence, pipeline management, and transaction execution.

Guided by its proprietary “Source–Match–Exit” model, Konzortia addresses market fragmentation by uniting investors, issuers, and intermediaries within a single intelligent infrastructure. Through its complementary platforms—Alpha Markets (secondary liquidity), Alpha Blocks (blockchain-secured transactions), and Alpha Terminal (real-time market intelligence)—Konzortia delivers a seamless, data-driven environment designed for speed, transparency, and smarter decision-making.

#PrivateCapitalMarket #AIInPrivateCapital #ArtificialIntelligenceInInvesting #DealSourcingAutomation #InvestmentLifecycle #VentureCapitalTechnology #PrivateEquityAnalytics #SecondaryMarkets #AIDrivenDealSourcing #PredictiveModelingInFinance #MachineLearningInInvesting #DataDrivenInvesting #InvestmentIntelligence #DigitalTransformationInFinance #InvestmentLifecycleOptimization