Building the Infrastructure for Private Market Growth: Konzortia Capital’s Long-Term Roadmap

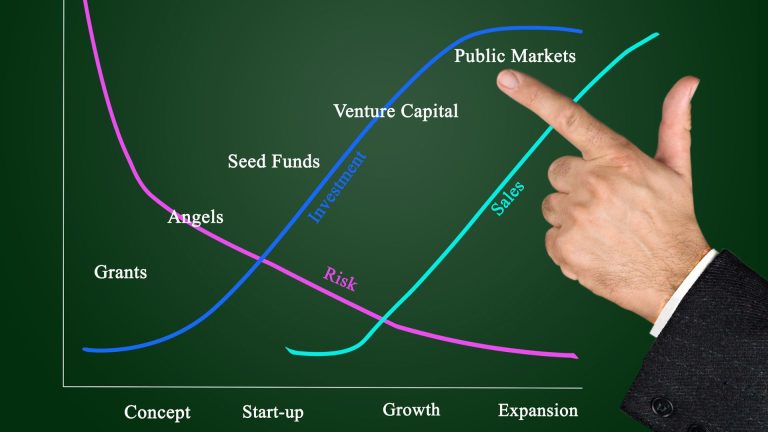

Private capital markets are evolving at an unprecedented pace. As of 2024, global private capital AUM surpassed $13.1 trillion, and it’s projected to reach $18.3 trillion by 2027, according to Preqin. This growth is being fueled by increasing interest from venture capital firms, private equity sponsors, angel syndicates, investment banks, and family offices seeking higher returns, longer horizons, and direct exposure to innovation.

Yet, the infrastructure supporting this booming market remains fragmented, opaque, and inefficient. To unlock the next wave of private market growth, a new kind of foundation is required—one that’s built for scale, transparency, and global collaboration.

Konzortia Capital: Building the Future of Private Markets

Konzortia Capital is not just building individual tools—it’s constructing a unified infrastructure designed to support the long-term evolution of private capital. As a next-generation FinTech company, Konzortia is creating a digital ecosystem that integrates AI, blockchain, predictive analytics, and intelligent marketplaces across a multi-platform architecture built for issuers and investors alike. The ecosystem consists of four key platforms:

1. Alpha Hub: An Integrated Platform for Smarter Investing

Alpha Hub is an AI-powered investment platform that is already transforming how investors manage deal sourcing, capital raising, and pipeline management. Designed for use by venture capital firms, private equity funds, angel syndicates, family offices, and strategic investors, Alpha Hub enables:

- Smart Deal Sourcing based on flexible investment criteria

- Predictive analytics to identify high-potential issuers

- CRM and pipeline tools to streamline transaction flow

- Real-time market insights to inform decision-making

This intelligent FinTech infrastructure provides a competitive advantage in an increasingly data-driven investment environment.

2. Alpha Markets: Unlocking Liquidity & Expanding Access (Coming Soon)

Private assets have long suffered from illiquidity, hindering exit opportunities and portfolio flexibility. Alpha Markets is a next-generation marketplace that aims to solve this challenge by:

- Enabling secondary transactions for private securities

- Facilitating fractional ownership models

- Connecting global investors with vetted issuers

- Using distributed ledger technology (DLT) to enhance speed, trust, and transparency

By improving liquidity, Alpha Markets will create a more dynamic and accessible investment environment for institutions and qualified individual investors.

3. Alpha Blocks: Blockchain-Driven Security & Transparency (Coming Soon)

Alpha Blocks leverages blockchain infrastructure to deliver verifiable, secure, and auditable transaction records. Future capabilities include:

- Smart contracts for automated capital deployments and compliance

- On-chain investor identity and KYC/AML verification

- Immutable record-keeping for transaction transparency

- Decentralized governance mechanisms for market oversight

This blockchain-powered FinTech layer reinforces the security and trust needed for cross-border capital flows and institutional-grade compliance.

4. Alpha Terminal: Data-Powered Investment Intelligence (Coming Soon)

With an overload of disparate data sources, investment professionals need centralized, actionable intelligence. Alpha Terminal will deliver:

- Real-time private market benchmarks

- Company and industry-specific analytics

- Sentiment analysis and trend forecasting

- AI-driven deal scoring and investment viability ratings

This FinTech analytics engine is designed to empower decision-makers—from GPs to LPs—with the data they need to act confidently in a competitive landscape.

As Walter Gomez, Founder of Alpha Hub, explains:

“We’re building more than a platform—we’re building the infrastructure for a more efficient, transparent, and intelligent private market ecosystem. Our long-term roadmap is focused on enabling investors and issuers to operate with greater precision, trust, and opportunity.”

Why It Matters for Investors

This infrastructure opens a compelling opportunity for institutional and professional investors—venture capitalists, private equity firms, angel syndicates, investment banks, and family offices—to invest in the foundational FinTech technologies that will drive the next decade of private market transformation.

By backing platforms like Konzortia Capital, investors gain exposure not just to innovation—but to the tools that power innovation.

Conclusion

The future of private capital markets will be shaped by FinTech platforms that can unify fragmented workflows, increase transparency, and scale across borders. Konzortia Capital’s vision is bold—and exactly what the market needs. Are you ready to invest in the infrastructure of tomorrow?

References:

- Preqin Global Private Capital Report 2024

- Campden Wealth – Global Family Office Report 2023

- PitchBook – Venture Monitor 2024

- World Economic Forum – The Future of Capital Markets, 2024

- Deloitte – Blockchain in Financial Markets: A Real-World Infrastructure, 2023

About Konzortia Capital: Konzortia Capital is a pioneering FinTech consortium and holding company committed to transforming the Private Capital Markets. We empower venture capital (VC), private equity (PE), angel syndicates, investment banks, and family offices with seamless deal sourcing and capital deployment tools, while also providing funding pathways for companies across all stages, from early startups to mature enterprises. Our guiding framework, Source – Match – Exit, is designed to streamline the investment lifecycle for both investors and capital-raising companies.

At the heart of our innovation is Alpha Hub, our flagship platform. Alpha Hub is redefining how investments are discovered, evaluated, and executed by integrating Artificial Intelligence (AI), Machine Learning (ML), and Distributed Ledger Technologies (DLT) into one powerful solution. By unifying AI-powered deal sourcing, blockchain-enabled transaction infrastructure, and secondary market functionality, Alpha Hub delivers an end-to-end platform that simplifies complexity and drives smarter decision-making.

This transformative approach enhances speed, accuracy, transparency, and ROI, positioning Konzortia Capital as a leader in the future of private market investing.

#PrivateMarkets #VentureCapital #PrivateEquity #AngelInvesting #InvestmentBanking #FamilyOffices #DealSourcing #BlockchainFinance #InvestmentPlatforms

————————————————————————–