Effects of Interest Rate Hikes on Borrowing Costs/Raising Capital

For the past year and more, the Federal Reserve has been raising rates 25 to 75 basis points at a time. While fighting inflation can be good for all, rising interest rates do have adverse effects on companies when they borrow or raise capital. The Fed is trying, at the same time it raises rates, to encourage a “soft landing” which avoids a recession.

Effects on borrowing

- With Fed rate increases, the Prime Rates for loans increase as well. This is an obvious drag on business flexibility and affordability to borrow money for business creation or expansion.

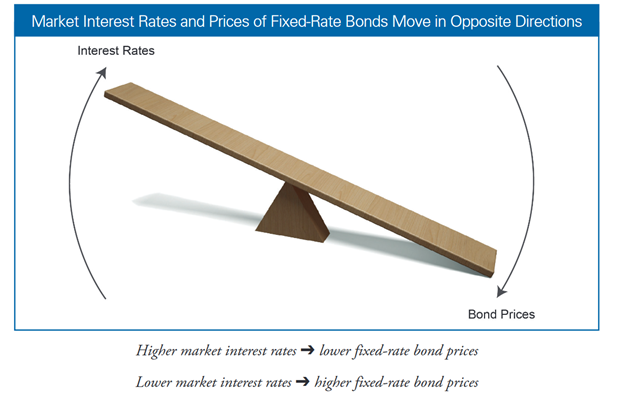

- Not quite so obvious is the effect on investment positions in bond holdings. As rates rise, the fixed interest rate on a bond means that its price falls to match current market rates of return on a purchase of that bond.

Banks have bond holdings. Losses on those positions tighten lending capital availability. Large market investors – like hedge funds or common mutual bond funds – tend to pull back on risk appetite when they see their principal value falling. It also means, though, that dollars coming to invest in capital markets may be more interested in bonds at these higher rates than in equities.

Source: Securities Exchange Commission www.sec.gov

Effects on capital raising

- Rising interest rates can mean that startups have greater difficulty raising funds from venture capital and private equity firms. Those investors are indirectly connected to the public markets of stocks and bonds. Funds may limit their investment exposure to keep enough cash on hand to meet their immediate needs and deploy when they believe they have a better grasp on market direction.

A study in 2017 by the European Financial Management Association tracked how an interest rate hike would affect 20 major VC markets over a 35-year period. A 1% increase in the interest rate would lower the fundraising of Venture Capital firms by 3.2%1.

A Simple Startup blog mentioned that the approximate $330 billion that was raised by VCs in 2021 would be lower by $10.5 billion if the interest rates were increased by 1% in the prior year.2

- A somewhat more complicated effect of rising interest rates on raising startup capital concerns the “discount rate” expected by investors on a startup’s projected future cash flow to compare with today’s dollars.

Consider: The investor can get a relatively high interest rate today on a bond investment judged to be low risk. That investor will expect more future startup cash for putting money into a high-risk investment. Those future dollars are “discounted” to match today’s dollars. It drives the current valuation of the startup downward. This is DCF valuation of a startup.

The scenario leads us to an interesting twist, though. There may be a positive effect on raising capital from rising interest rates. Quite simply, the rate environment causes startup founders to lower their valuations. Instacart is a recent example of a company that cut valuation in coming to capital markets for funding.

Some interpret the data to say that Instacart and other startups acting in a similar way ended up getting more investment money by attracting investors who sit on the sidelines for issues they believe to be richly or even over-priced. They come shopping with investment dollars to get a bargain. Today’s valuation cut may give the startup more total investment to then end up making more money from the project.

1Do Interest Rates Affect VC Fundraising and Investments? Credited to Cristiano Bellavitis and Natalia Matanova on the paper but was for the European Financial Management Association.

2How Rising Interest Rates Will Affect the Venture Capital Market; blog entry by Lorne Noble, April 11, 2022, https://simplestartup.com/blog/how-rising-interest-rates-will-affect-venture-capital-market/

How do Rising Interest Rates Affect Venture Capital?; https://www.propelx.com/blog/how-do-rising-interest-rates-affect-venture-capital/, July 26, 2022