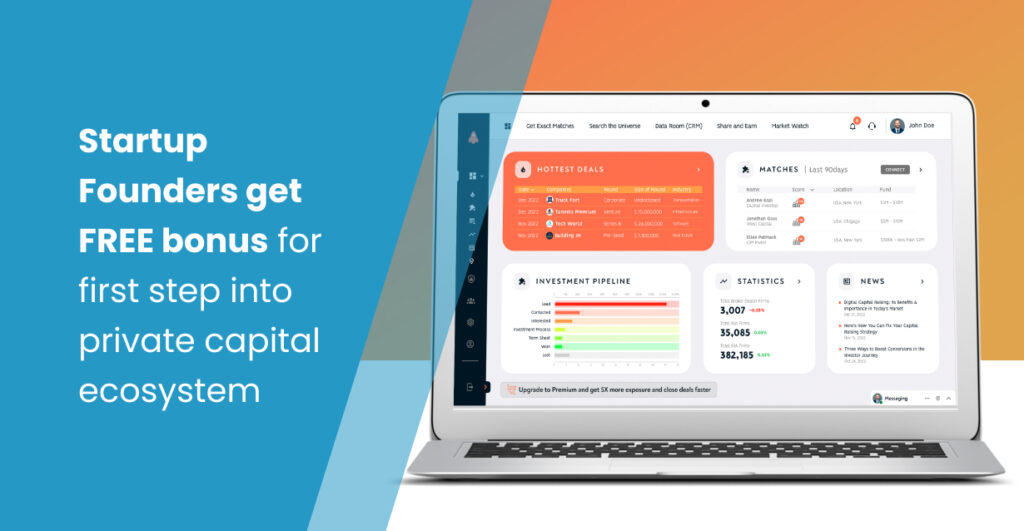

Startup Founders get FREE bonus for first step into private capital ecosystem

FOR IMMEDIATE RELEASE

Startup Founders get FREE bonus for first step into private capital ecosystem

A new private capital deals platform is premiering to help Founders pursue capital investment successfully. Taking a first step now onto this platform is FREE for the introductory, pre-launch period AND gives an extended three months free for startups joining now.

InvestHub by Konzortia Capital serves private capital dealmakers by connecting Founders and Funders using Artificial Intelligence and Machine Learning. Private capital transactions include both equity and debt financing on InvestHub. Included also in the platform are powerful capabilities for M&A participants. Now, a Beta version is launching as a step toward a transforming private capital ecosystem.

Startups seeking capital have new support in their search. In further development by the 4th quarter, the Platform will introduce Startups to Investors and Investors to Startups. That functionality will be InvestHub 1.0. With InvestHub 2.0, rolled out in stages over a year’s time, the platform will include full FINRA-member Broker Dealer services and an SEC-licensed Alternative Trading System (ATS) for liquidity of private capital positions. Prime value users of the platform include M&A transactors and debt financing investors as well as VC and PE funds and Angel Investors.

Startup Founders are offered free, pre-launch use of Konzortia Capital’s new InvestHub platform, Beta version. Participation now qualifies startups for an additional free three months of platform participation when InvestHub 1.0 launches with greatly increased capabilities in the 4th Quarter of this year.

Involvement now on InvestHub makes a database of more than 800,000 VC/PE/Institutional and Other investors available. Data is collected and kept current by broad and deep source cultivation through Artificial Intelligence (AI) and Machine Learning (ML). From criteria selected by Startups, InvestHub’s AI will curate a set of matched Investors for Founder preferences.

For investors, matches with startup projects will be chosen to fulfill VC and PE fund objectives. Debt financing investments are facilitated on the platform, as well as M&A transactions. A consistent Deal Flow can be offered through InvestHub’s growing global reach to capital projects across a broad range of sizes and geographical criteria. In addition, General Partners (GP) and Limited Partners (LP) can use InvestHub matching to build investment syndicates with similar capital return objectives.

The platform fully deployed has a place for the company needing funding and the investor deploying capital in equity, debt, and M&A transaction deals. Additionally, through Distributed Ledger blockchain technology, digital ownership shares will be created to offer real-time, secure settlement and later opportunity for liquidity on the ATS. This describes the core highlights of the coming private capital ecosystem.

Konzortia is scaling the offering of this investment platform with a Seed capital funding round now. Contact below for further information.