Tecxar commits to equity and AI development of nearly $500k for InvestHub by Konzortia

FOR IMMEDIATE RELEASE

Tecxar commits to equity and AI development of nearly $500k for InvestHub by Konzortia

Tecxar, a global AI and enterprise software development firm, has just committed to a nearly $500k equity and services agreement with Konzortia Capital. Development work will advance Konzortia’s InvestHub private capital deals platform for continuing improvements in its market-changing product.

What began through Konzortia’s RFP outreach to stellar software development companies then matured over the month of discussions. Today’s commitment to a two-year services contract consists primarily of equity participation by Tecxar in the advancement of InvestHub. This equity portion is one of the largest investor commitments received in the last three months by Konzortia.

Konzortia Founder and CEO Walter Gomez characterizes the deal as “a breakthrough advance for us.” Gomez says “Tecxar is a globally recognized, cutting-edge developer in AI and multiple dimensions of enterprise software. Their work on InvestHub looks to make a strong product continue growing into a phenomenal one.”

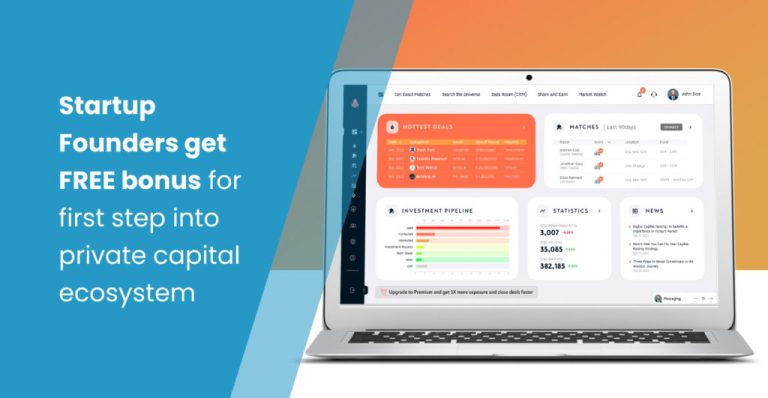

InvestHub by Konzortia Capital serves private capital dealmakers by connecting Founders and Funders using Artificial Intelligence and Machine Learning. Private capital transactions include both equity and debt financing on InvestHub. Included also in the platform are powerful capabilities for M&A participants. Now, a Beta version is launching as a step toward a transforming private capital ecosystem.

With the power and flexibility of AI, InvestHub comprehensively serves a broad variety of profitable users in private capital markets. There are clear use cases and performance-tuned functionality for investment bankers, PE firms, placement agents, Venture Capitalists, Angel investors, broker-dealers, business brokers, and GPs/LPs seeking like-interested investment partners.

Tecxar has worked successfully in development toward billion-dollar exits in Fintech along with innovative creations in AI/ML and blockchain. Founder and CEO Sonia Sharma comments on the development project agreement. “We get the opportunity to help Konzortia bring InvestHub 1.0, 2.0, and OTC forward over the next two years. Our programmers and data scientists at Tecxar add successful experience and creative genius to this partnership with Konzortia’s market insight and transformative vision for InvestHub.

More specifically about their equity investment in Konzortia’s future the Tecxar head says “As is obvious from our growing equity position in the company, we are confident InvestHub will bring real market transformation to private capital. We get to partner in that work and profit from that endeavor.”

Involvement now on InvestHub makes a database of more than 800,000 VC/PE/Institutional and Other investors available to startup Founders. For investors with the coming InvestHub 1.0, matches with startup projects will be chosen to fulfill VC and PE fund objectives. Debt financing and M&A are supported comprehensively, as well.

InvestHub can bring a consistent Deal Flow through its growing global reach to capital projects across a broad range of sizes and geographical criteria. In addition, General Partners (GP) and Limited Partners (LP) can use InvestHub matching to build investment syndicates with similar capital return objectives.

Konzortia is scaling the offering of this investment platform with a Seed capital funding round now. See for further information: www.konzortiacapital.com and www.investhubventures.com.